Why Your Credit Score Matters (But Also Kind of Doesn’t)

Photo courtesy of See-ming Lee

People spend a lot of time worrying about their credit score.

There are certain situations where this makes a lot of sense (like if you’re about to buy a house). But there are many more situations where all that worry is much ado about nothing.

Yes, your credit score matters. But it also kind of doesn’t.

Here’s why.

Yes, it matters…

Okay, let me get this out of the way from the start: yes, there are situations where your credit score definitely matters.

The obvious example is if you’re buying a house. Very simply, the better your credit score, the lower the interest rate you’ll have to pay for a mortgage. And the lower your interest rate, the less money you’ll actually have to pay over the life of the mortgage.

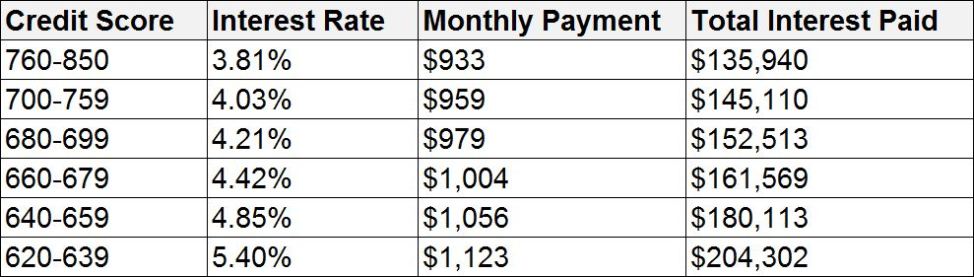

MyFICO has a Loan Savings Calculator that shows you average mortgage rates for different credit score ranges. On 6/5/2014 I ran the numbers for a $200,000 mortgage in the state of Florida and got the following results:

The difference in cost between the highest and the lowest credit scores is almost $200 per month and just about $70,000 over the course of 30 years. Those are some big numbers, so yes, your credit score does matter.

But…

…but it also kind of doesn’t matter

Clearly, if you plan on taking out a big loan in the near future then you should probably spend some time worrying about your credit score.

But otherwise, focusing on your score is mostly a waste of time. Here’s why.

The “tricks” for improving your credit score are the same things you should be doing anyways

Paying your bills on time.

Not taking on more debt than you can afford.

Keeping an eye out for identity fraud (see this for a decent guide).

These are the things that will give you that top-tier credit score if you keep doing them again and again over an extended period of time. They’re also the kinds of things you should be doing anyways, whether or not such a thing as a credit score actually existed.

For the most part, your credit score will reflect whether or not you have good financial habits. So it’s your regular habits that really matter, not any “tips and tricks” for improving your credit score. If you focus on creating those rock-solid financial habits, the kinds of things that are good for you no matter what, your credit score will take care of itself.

There’s not really one score

People like to talk about your credit score like it’s a single number. That couldn’t be further from the truth.

Ask any of the three different major credit rating bureaus what your credit score is and you’ll get a different answer. Go to the bank on Main St. and you’ll get a fourth answer. What if you want a mortgage loan vs. an auto loan? Yep, different scores.

If you’re about to do something very specific in the near future, like buy a house or take out a car loan, then you can talk to the actual lenders you might use and they’ll give you an actual score for that specific thing you’re trying to do at that specific point in time. Otherwise, which target are you trying to hit? Focusing on any one specific score just doesn’t make a lot of sense.

Do you really need to care about your score?

If you want to buy a house within the next year, then yes you should probably care about your credit score a little more than most. Talk to a couple of lenders and find out what kind of shape you’re in. If there are any specific things you could do to improve your score with them (and therefore improve the interest rate you might get), then those things are probably worth doing.

But if there’s no near-term need, then why even worry about it? Assuming you’re already practicing those good habits on a regular basis, would a short-term hit to your credit score really matter?

Let’s say for example that you want to open a certain new credit card, maybe because it has a better rewards program than your current credit card. But you heard that opening a credit card might hurt your credit score, so you hesitate. Why? Does it matter if your credit score drops a few points right now? Do you need it to be high for any specific reason? If not, then the decision should be based entirely on whether opening up this credit card is actually a good idea, not how it will affect your credit score.

Don’t worry about your credit score unless you really have to.

So, what you should do?

First, unless you’re buying a house (or something similar) in the near future, stop worrying about your credit score. Yes, keep an eye on your credit report to watch out for identity theft or other inaccurate information. But whatever your score is today doesn’t really matter.

Second, focus on the basics. Keep doing the things you should be doing whether or not your credit score existed. Live below your means. Pay your bills on time. Don’t take on more debt than you can afford. If you want a list of things you should actually be worrying about, here it is: The 8 Most Important Financial Steps a New Parent Can Take.

The real point here is this: you should be making financial decisions based on whether or not they’re good financial decisions, not based on how you think they might affect your credit score. If you just keep doing that, your credit score will take care of itself.

Hi Matt

We will be renewing our mortgage sometime between Oct and Mar, so your info is quite timely for me. We have a low-rate balance transfer credit card that has $6K on it now but will be paid by August. I won’t take any more out until our mortgage renewal is completed. Other than that, all other credit cards are current and we are also doubling up our mortgage payments right now to shorten the amortization. I think I will get my credit score before going in to negotiate, so that I have all the information. Unfortunately, here in Canada we need to pay to get the score, but we can get 2 free credit reports per year.

Actually, we generally need to pay to get our actual score here too. The credit report is free, but the score isn’t. Anyways, sounds like you’re taking some smart steps with a refinance on the horizon. Good luck!

Thorough post, Matt (per usual). Something we discovered on the podcast recently (and a huge reason to check your free credit report): credit card companies can find you and approve you WITHOUT your Social Security number. Meaning? If you’ve ever had your credit accessed by someone with the same name (who isn’t you) that could be a case of mistaken identity by the retailer (not actually theft….but just as bad).

Wow, pretty interesting. Why are the credit card companies doing that? My first thought was that they were relaxing their standards, but they wouldn’t need to stop checking the SSN to do that. In any case, like you say, even more reason to stay on top of your report.

I have no idea. It’s strange. Paula Pant (who brought up the point) actually called the credit card company to find out how Will was added to her card without a SSN. They just kept saying “They didn’t need it” and “I don’t know.”

You’re right…ugly….

Thanks for including our post, Matt! You’re absolutely right – the behaviors required to keep a high credit score are the things you’re likely doing anyway (such as paying accounts on time). Solid payment behavior + history is really all most people need to have a high score!

No problem!

My credit score matters for the two reasons mentioned above. Better rewards credit cards, and access to low-rate loans when needed. But I don’t need a loan unless buying an appreciating asset (aka Land or Housing), so mostly I keep it up for the credit card rewards.

Outside of that, I couldn’t care less about it.

You and your credit card rewards. I still kind of feel like an idiot when I read some of the posts on that stuff. I’ve taken advantage of a few different sign-up bonuses now though and it is pretty cool.

I try to make sure my credit score is over 720, but I don’t really care other than that. There is no awards ceremony for a 800+ score! =)

Very true! Or if there are, they keep them very secret.

One of the better takes on credit scores that I’ve ever read, Matt. It’s really only important to the degree that you need to borrow a lot of money.

Here’s another take: if your credit score is poor enough that your rate of borrowing for a home is more expensive, you have to ask whether you’re totally ready to buy a home. Not to be a dick, but credit scores aren’t open to a lot of interpretation. If your scores are suffering, there’s a reason.

Thanks! And I would generally agree with that. I think there are some circumstances where it might make sense to buy even with a lower credit score, but in general you’re right that a lower credit score probably means that there are some habits to work on before taking on the big financial commitment of a house.

The last paragraph in this post is my favorite, Matt. Good financial decisions should be made simply on their own stand-alone basis, credit score not included, as long as there’s not a house purchase or something else major coming up soon. Great post as usual. 🙂

Thanks Laurie!